Views: 0 Author: Site Editor Publish Time: 2026-02-02 Origin: Site

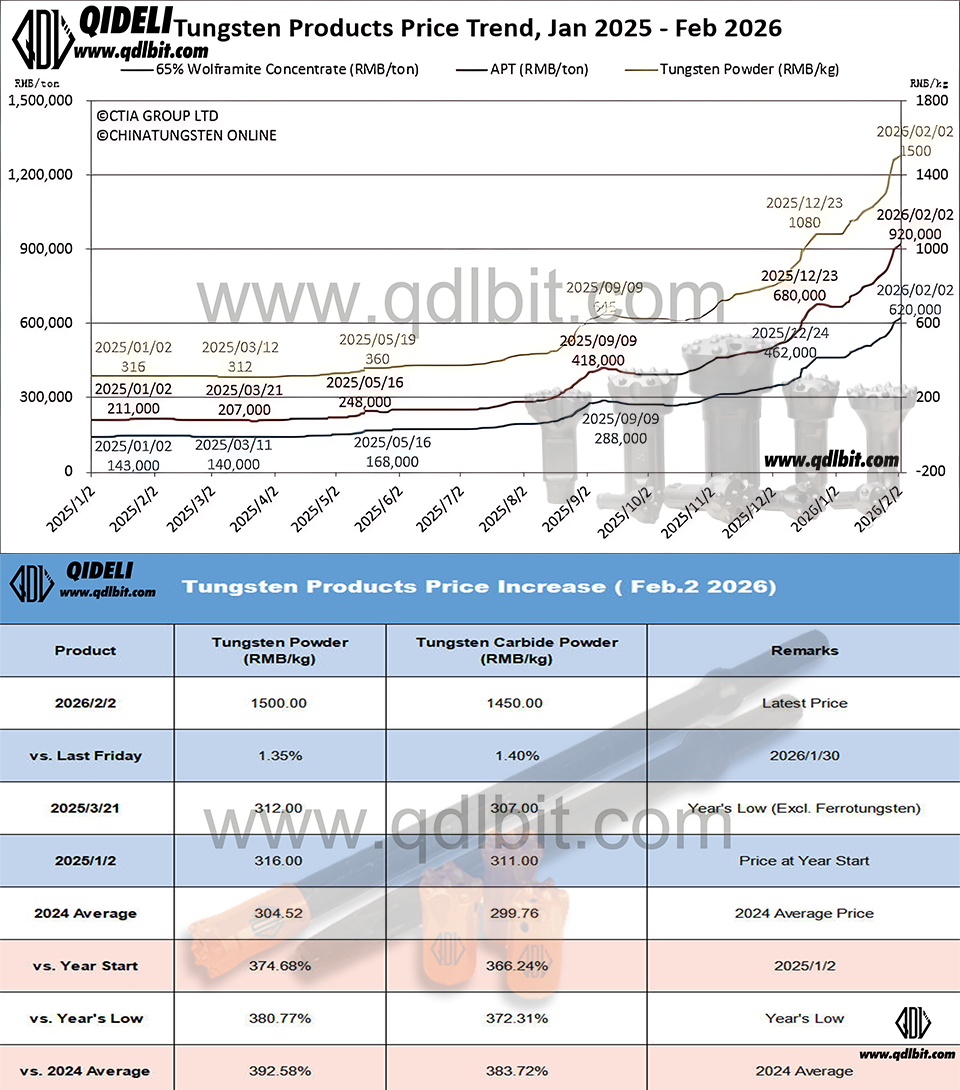

Despite a sharp slump in the precious metals market, the tungsten sector has maintained a strong upward trajectory, with prices hitting successive new highs. As of the latest update from Chinatungsten Online, major tungsten products have seen substantial gains year-to-date. Specifically, 65% wolframite concentrate stands at RMB 620,000/ton, representing a 34.8% increase from the start of the year. Similarly, 65% scheelite concentrate is priced at RMB 619,000/ton, up 34.9% year-to-date. Ammonium paratungstate (APT) has reached RMB 920,000/ton, rising by 37.3%, while tungsten powder stands at RMB 1.5 million/ton, up 38.9%. Other key products including tungsten carbide powder, ferrotungsten, and tungsten scrap have also recorded significant increases.

Entering the final two trading weeks before the Spring Festival, domestic tungsten industry manufacturers are gradually entering holiday mode. This shift is expected to lead to slower production and trading activity, accompanied by a more cautious and wait-and-see market sentiment.

Inventory holders currently face a clear dilemma. On one hand, high costs and tight spot supplies continue to underpin price support. On the other hand, growing demand for pre-holiday capital repatriation, uncertainties over post-holiday market trends, and international political-economic risks have left many holders hesitant between selling at current high prices and continuing to hold inventories.

Rising Hard Alloy Costs Create Pressure for the Drilling Tools Industry

As tungsten carbide powder prices continue climbing, the cost of producing hard alloys is rising in parallel.

Tungsten carbide is one of the core materials used in the drilling tools industry, and cost increases directly affect the following products:

DTH drill bits

Button bits

Chisel bits

Cross bits

Threaded bits

PDC products that include a hard-alloy matrix

For manufacturers, high raw material prices are compressing profit margins and forcing an adjustment in product pricing structures across the industry.

QIDELI Outlook: Industry Trends in a High-Cost Era

Based on feedback across the supply chain, there is still no clear sign of price correction in the short term.

Tight resource availability, strong market sentiment, and active capital inflows together indicate that tungsten prices will remain at elevated levels.

Against this backdrop, the drilling tools industry is expected to enter:

A cost-sensitive period

A product restructuring period

A phase of rising demand for high-quality products

QIDELI will continue to closely monitor upstream raw material price changes and provide clients with timely market insights and professional guidance.

QIDELI remains committed to quality-first principles, maintaining high standards in raw material sourcing and production process control.

Even in volatile market conditions, QIDELI will ensure stable product quality and reliable supply—a promise we uphold for our global customers as we face this new industry cycle together.

Putian Qideli Engineering Equipment Co.,Ltd. is responsible for Qideli's self-ownedexport business. We start international business in 2017.

No.19, Houdong, Dongpuyu, Xindu, Licheng District, Putian, Fujian, China