Views: 0 Author: Site Editor Publish Time: 2025-11-17 Origin: Site

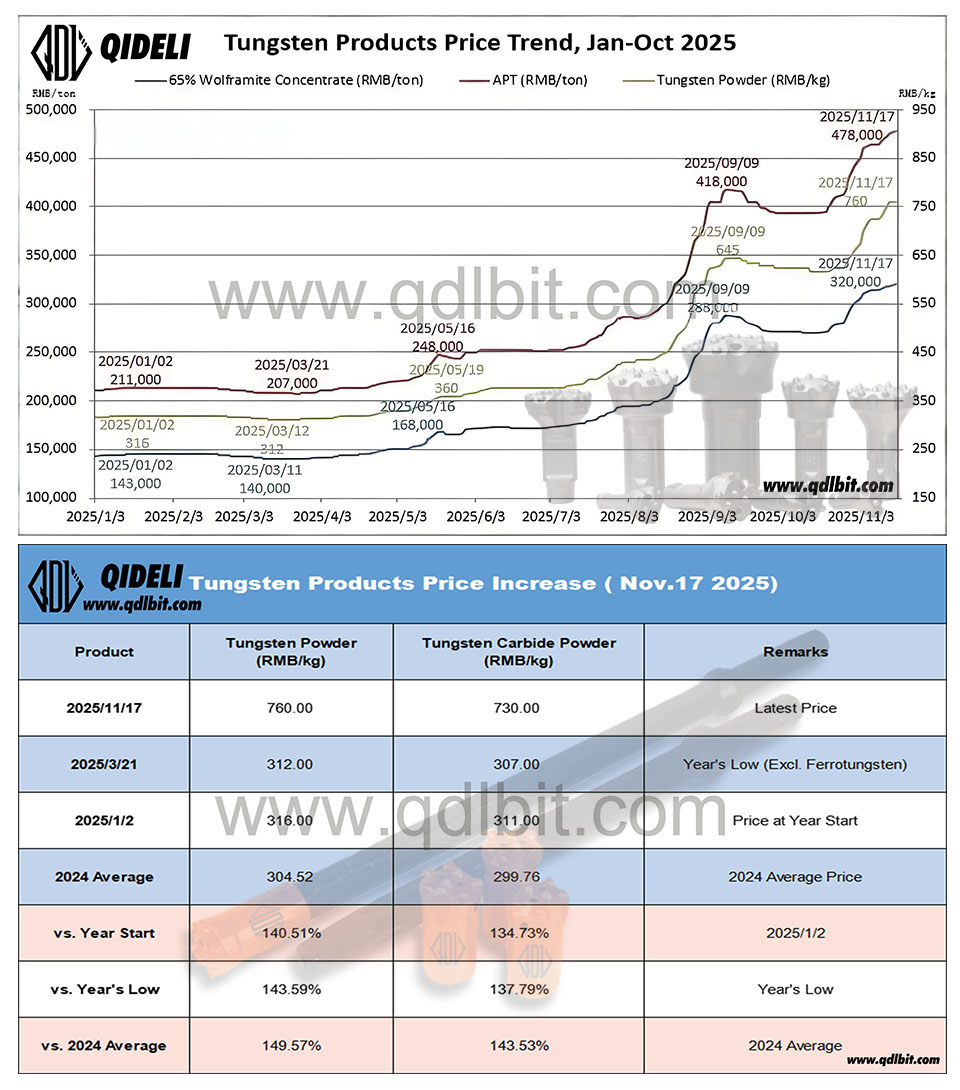

On November 17, 2025, the tungsten market opened the week with overall stable performance, although trading activity remained relatively subdued.

Recent tungsten ore auctions have yielded favorable results, further strengthening miners’ confidence in holding firm prices. Upstream quotations remain strong with limited willingness to concede. Although sentiment on the raw material side is slightly bullish, downstream terminal users continue to adopt a cautious procurement strategy, mainly purchasing on demand and adjusting passively in response to cost changes. Market participants generally maintain strong wait-and-see attitudes.

In the tungsten scrap market, earlier pessimism has eased, and sellers have reduced their willingness to ship at lower prices. Overall, both upstream and downstream segments of the tungsten industry remain in a state of stalemate, with moderate market liquidity and slow transaction rhythm. Market participants are paying close attention to the mid-to-late-month long-term contract prices to be issued by major tungsten enterprises, which are expected to play an important guiding role in upcoming market trends.

Rising Tungsten Carbide Prices Continue to Pressure Hard Alloy Costs for Drill Bits

With tungsten prices maintaining high-level volatility and showing a slight upward bias, tungsten carbide (WC) prices have risen accordingly. As the core raw material for cemented carbide, the increasing cost of tungsten carbide directly drives up the production cost of carbide tools and drill bits.

This affects products such as:

• DTH drill bits

• Button drill bits

• Chisel bits and cross bits

• Thread drill bits

All of these rely heavily on tungsten carbide buttons or carbide cutting inserts, meaning product prices may undergo varying degrees of adjustment as cost pressure intensifies.

For drill tool manufacturers, this not only increases production costs but also puts higher demands on inventory planning, raw material purchasing strategies, and product pricing decisions.

Industry Recommendations

In the current market environment, both manufacturers and clients should closely monitor:

• Trends in tungsten ore auctions and long-term contract prices from major tungsten producers

• Changes in cemented carbide production costs

• Demand recovery within engineering and mining sectors

QIDELI will continue to track market developments and provide customers with timely and reliable industry updates, offering transparent and reasonable pricing references as market conditions evolve.

Putian Qideli Engineering Equipment Co.,Ltd. is responsible for Qideli's self-ownedexport business. We start international business in 2017.

No.19, Houdong, Dongpuyu, Xindu, Licheng District, Putian, Fujian, China