Views: 0 Author: Site Editor Publish Time: 2025-12-03 Origin: Site

Since the beginning of 2025, China’s tungsten market has maintained a strong upward trend, with overall price levels continuing to rise steadily. The industry has clearly entered a sustained “bull market cycle.”

This round of price increases is mainly driven by three factors:

Tight raw material supply, with limited release of high-quality resources both domestically and internationally;

Increased capital inflow into key mineral sectors;

Higher-than-expected long-term contract prices released by major tungsten producers earlier this week, which further strengthened market sentiment.

Despite the rapid rise in tungsten prices, downstream end-users remain cautious and generally show reservations toward continuously escalating production costs. Many enterprises “do not agree but must accept” due to rigid demand.

Overall market liquidity remains limited, with transactions mainly concentrated in long-term contract execution and small-volume essential purchasing. Spot market activity is still relatively low.

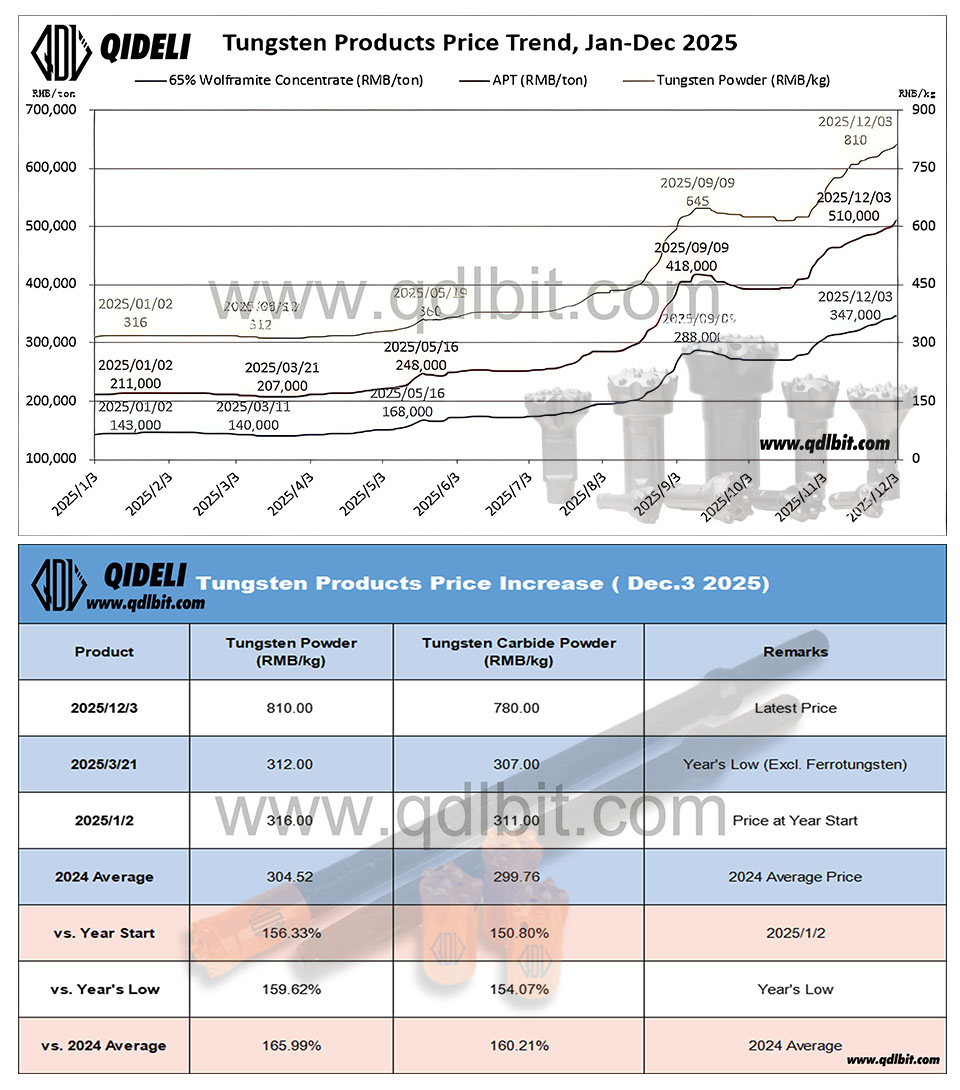

Tungsten Product Prices Continue Setting New Highs

In the tungsten powder market, the high price level of raw materials has led suppliers to avoid offering fixed quotations, instead opting for “one-order-one-negotiation”.

Buyers maintain a strong wait-and-see attitude, and actual transactions are mostly restricted to necessary small-volume orders.

Current market levels indicate:

Tungsten powder: 810 RMB/kg, up 156.3% from the beginning of the year

Tungsten carbide powder (WC): 780 RMB/kg, up 150.8% year-to-date

The continuous price surge highlights the scarcity and strategic importance of tungsten resources, and it will continue to reshape cost structures across hard alloy production and downstream industries.

Rising Hard Alloy Costs Create Pressure for the Drilling Tools Industry

As tungsten carbide powder prices continue climbing, the cost of producing hard alloys is rising in parallel.

Tungsten carbide is one of the core materials used in the drilling tools industry, and cost increases directly affect the following products:

DTH drill bits

Button bits

Chisel bits

Cross bits

Threaded bits

PDC products that include a hard-alloy matrix

For manufacturers, high raw material prices are compressing profit margins and forcing an adjustment in product pricing structures across the industry.

QIDELI Outlook: Industry Trends in a High-Cost Era

Based on feedback across the supply chain, there is still no clear sign of price correction in the short term.

Tight resource availability, strong market sentiment, and active capital inflows together indicate that tungsten prices will remain at elevated levels.

Against this backdrop, the drilling tools industry is expected to enter:

A cost-sensitive period

A product restructuring period

A phase of rising demand for high-quality products

QIDELI will continue to closely monitor upstream raw material price changes and provide clients with timely market insights and professional guidance.

QIDELI remains committed to quality-first principles, maintaining high standards in raw material sourcing and production process control.

Even in volatile market conditions, QIDELI will ensure stable product quality and reliable supply—a promise we uphold for our global customers as we face this new industry cycle together.

Putian Qideli Engineering Equipment Co.,Ltd. is responsible for Qideli's self-ownedexport business. We start international business in 2017.

No.19, Houdong, Dongpuyu, Xindu, Licheng District, Putian, Fujian, China