Views: 0 Author: Site Editor Publish Time: 2025-11-28 Origin: Site

In November 2025, China’s tungsten market continued its strong upward trend, with overall price resilience significantly surpassing industry expectations. Driven by a tight supply–demand balance and intensified global competition for critical minerals, the strategic value of tungsten resources has become increasingly prominent. This has pushed both domestic and international tungsten product prices sharply higher. Multiple factors—such as sellers’ strong reluctance to ship, major producers lifting long-term contract prices, and rising international tungsten prices—have jointly fueled this month’s robust momentum.

Tungsten Powder Leads the Surge: Rapid Price Increases Boost Market Sentiment

During the first half of November, tungsten powder products took the lead with an aggressive surge, at times showing “daily increases worth thousands,” which quickly boosted market sentiment.

In the latter half of the month, tungsten concentrate prices continued their steady upward trajectory, providing solid cost support across the entire industrial chain. With tungsten raw material costs cumulatively rising by approximately 150%, producers of tungsten materials, tungsten alloys, and cemented carbide generally initiated their 5th–6th rounds of price adjustments this year.

November Price Data: Sharp Increases in Tungsten Powder and Tungsten Carbide Powder

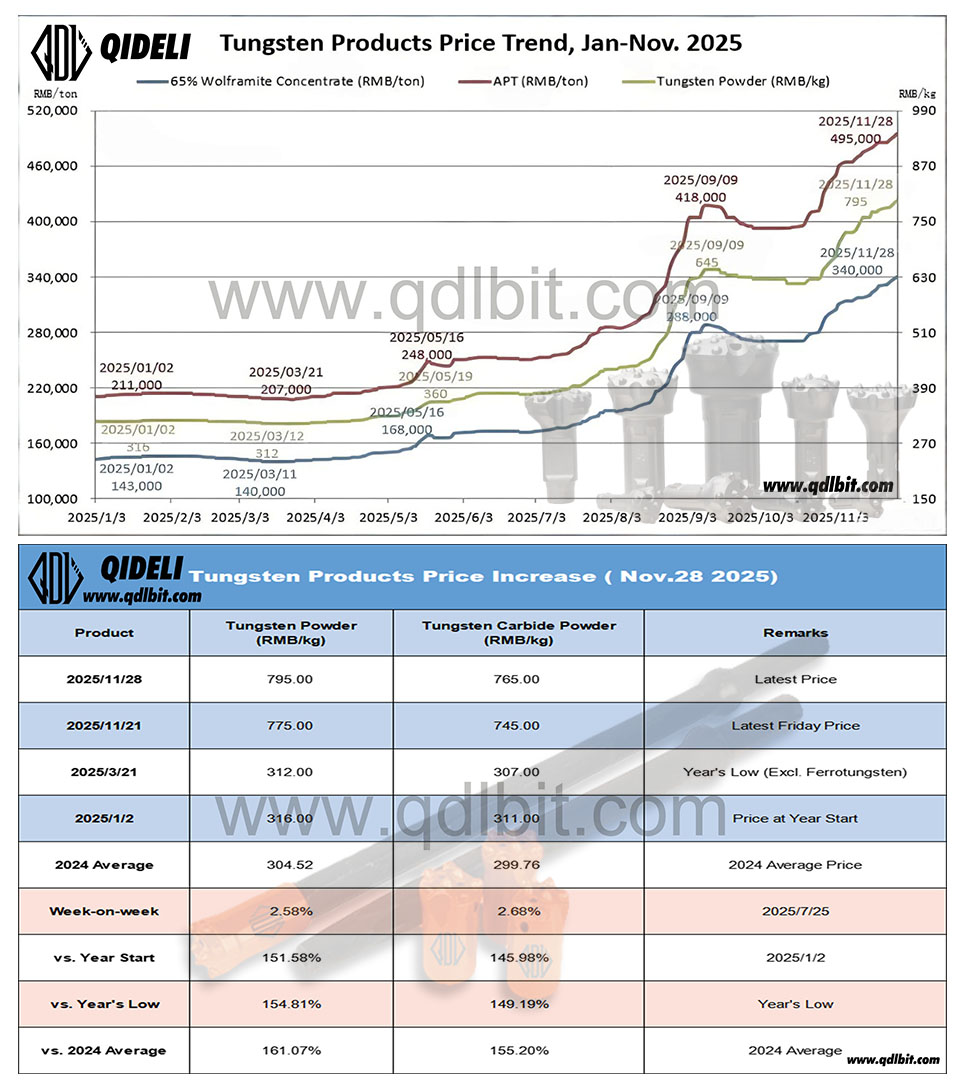

Price performance of major tungsten products in November 2025:

Tungsten powder average price: 750.50 RMB/kg

MoM +19.76%, YoY +137.46%, end-of-month vs. beginning +17.78%.

Tungsten carbide powder average price: 725.00 RMB/kg

MoM +18.53%, YoY +133.08%, end-of-month vs. beginning +15.91%.

January–November 2025 cumulative averages further confirm the strong upward trend:

Tungsten powder: 444.18 RMB/kg, YoY +46.41%, end-November vs. start-year +151.58%.

Tungsten carbide powder: 434.39 RMB/kg, YoY +45.45%, end-November vs. start-year +145.98%.

These figures highlight the rapid rise in tungsten raw material prices throughout the year, significantly increasing cost pressure on downstream cemented carbide production and finished drilling tools.

High Prices Pressure End-User Demand as the Market Shows Both Caution and Fear of Heights

Although tungsten concentrate remains strongly supported, elevated prices are beginning to weigh on end-market demand. Industry sentiment is largely characterized by cautious observation, with both chasing high prices and fearing high prices coexisting. Purchasing activities have slowed compared with earlier months.

Key market concerns moving forward include:

Whether supply–demand fundamentals will shift at the margin;

Uncertainty stemming from global economic and geopolitical developments;

Downstream industries’ tolerance for high prices and potential changes to inventory strategies.

With many variables in play, tungsten prices show no clear signs of peaking in the short term, and volatility may continue to intensify.

QIDELI’s Perspective: Upstream Cost Pressure Intensifies, but We Remain Committed to Stable Supply, Quality, and Pricing

As tungsten carbide prices continue rising, production costs for cemented carbide increase sharply, directly driving up the manufacturing cost of drilling tools, including:

DTH bits

Button bits

Chisel and cross bits

Thread bits

Other carbide tooling products

During this high-sensitivity cost cycle, QIDELI remains committed to:

1. Strict control of raw-material quality and supply stability

Maintaining long-term cooperation with core powder suppliers to reduce the impact of market volatility.

2. Process optimization and efficiency enhancement

Upgrading production processes and equipment to slow the cost-transmission pressure passed to customers.

3. Transparent and timely market information

Helping customers make informed purchasing decisions and maintain stable production during volatile market conditions.

4. Flexible pricing and inventory strategies for long-term partners

Including transitional pricing buffers and pre-stocking programs to mitigate risks arising from market uncertainty.

QIDELI will continue to provide reliable drilling tools and cemented carbide products to global customers while closely monitoring tungsten market developments and sharing timely, authoritative insights.

Putian Qideli Engineering Equipment Co.,Ltd. is responsible for Qideli's self-ownedexport business. We start international business in 2017.

No.19, Houdong, Dongpuyu, Xindu, Licheng District, Putian, Fujian, China